Disclaimer

The results obtained from these calculators are for general purposes only to illustrate the effect of compound interest and are not intended as a substitute for professional financial advice. Before making any financial decisions on the basis of these results, you will need to consult with an independent financial planner or accountant as well as consider whether the advice is suitable to meet your personal financial objectives and circumstances.

The actual performance of any investments will depend on future economic conditions, investment management, fees and taxation. Past performance is no guarantee of future performance and as a result of this, all the results are hypothetical and are NOT GUARANTEED.

Nambawan Super specifically disclaims any liability for any direct, indirect, incidental, consequential or special damages arising out of or in any way connected with the access to or use of these calculators. To the extent permitted by law, under no circumstances will Nambawan Super be liable for any loss or damage caused by a user's reliance on the information by using these calculators.

Assumptions

Projected super balance at retirement:

The projected total super balance takes into account your starting balance, employee and employer contributions, any additional voluntary contributions as well as interest earned between now and your retirement.

Retirement age:

We have assumed a default retirement age of 65. This can be adjusted in the calculator.

Working life:

The calculator assumes that you will have a continuous working life with no breaks up to your retirement age.

Interest rate:

The default investment returns have been set at 6.0%. This is based on the Nambawan Super 10-year average interest rate.

Employee contributions:

PNG Superannuation laws dictate that 6% is the mandatory minimum contribution for employees to make. Employees may choose to contribute more than the minimum.

Employer contributions:

PNG Superannuation laws dictate that 8.4% is the mandatory minimum contribution that employers have to make. Employers may choose to contribute more than the minimum.

At 31 December 2024, Nambawan Super's strong performance has been delivered amidst unprecedented challenges faced by the Fund in 2024; from the Black Wednesday riots that shook the country on January 10, through to the enormous work undertaken to secure vacant possession of NSL’s 9-Mile land portions after more than 30 years. Despite these and many other challenges, the Board, Management and Staff remained resolute in putting Members’ interests first and foremost, tirelessly working to deliver strong results in 2024.

What is NSL's Crediting Rate?

At NSL, the Members' superannuation investment return is determined by a Crediting Rate.

At NSL, the Members' superannuation investment return is determined by a Crediting Rate.

Ideally, the Members' crediting rate is equal to NSL's Net Profit After Tax, after allowing for any reserves (if applicable). This is referred to as Net Surplus Available to Members, which is then distributed to all Members of the Fund.

NSL determines an Annual Crediting Rate early each calendar year which is applied to the Member account balances retrospectively for the period from 1 January to 31 December of the previous year.

NSL also determines and applies an Interim Crediting Rate in the event that a Member exits the Fund, such that the Member's final entitlement includes an earnings rate for the period from the most recent Annual Crediting Rate till the date of exit.

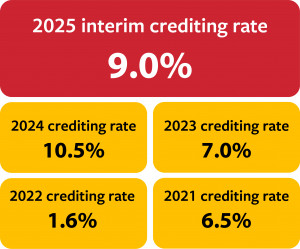

Nambawan Super's current Interim Crediting Rate stands at 9.0% (as of 11 February 2026)

You can read Nambawan Super's Crediting Rate Policy here.

Updates from the most recent Financial Results declaration

Nambawan Super delivered the following results to Members in 2024;

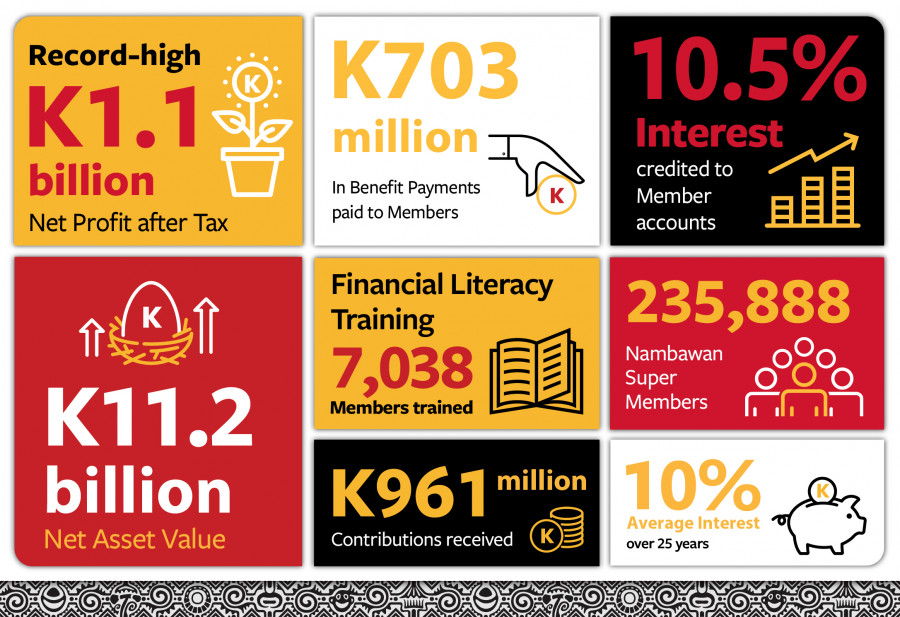

- Fund Membership grew by 3.3% to 235,888 Members, from 228,319 in 2023;

- Net Asset Value now totals K11.2 billion, an increase of K1.36 billion compared to K9.84 billion in 2023.

- Net Profit After Tax a record-high of K1.1 billion, representing a significant increase of K425 million from the 2023 NPAT of K659 million.

- Annual interest rate of 10.5% return for Members compared to 7% in 2023.

- Member Contributions Received totalled K961 million, compared to K970 million in 2023.

- Member Benefits Paid totalled K703 million paid out through Exits such as resignation; retirement, Death Benefit Payments, Transfers, Unemployment Benefits, Housing Advances and RSA Withdrawals to Members and or Member Beneficiaries, compared to K781 million paid out in 2023.

Nambawan Super Limited’s incoming Board Chairman, Mr. Richard Sinamoi, said that with the ever-increasing law and order issues coupled with increasingly unreliable utilities, all of which significantly add to the challenges and costs of local business operations, NSL also continued to face the ongoing issue of securing adequate foreign currency. Locally, investment opportunities continued to lag while international markets appreciated, though still very volatile.

“Throughout all of these challenges, the successful results of 2024 demonstrate the resilience of the Board, Management and Staff of NSL, who amidst these very unique and trying times, have continued to keep their focus on the Fund’s core purpose; our Members. Through strong governance and prudent management, the Fund has delivered on its mandate to protect and grow our Member’s retirement savings.”

“In 2024, despite the tough economic conditions, our financial performance has shown very strong results due to the appreciation of the prices of overseas equities, and the price of BSP Financial Group, both on PNGX and ASX.”

“Locally the Fund’s assets did not perform well, with lower dividends realised from the Fund's unlisted equity holdings and reduced rental income. State securities, however, have seen significant investments yields, which prior to this year have been declining. Investment Properties increased due to the valuation of Portion 2158 of the 9-Mile Land Portions. The Fund's listed equities performed well, driven largely by the strong performance of BSP Financial Group, Credit Corporation PNG and SP Brewery.”

“Additionally, foreign exchange gains, largely driven by the Bank of PNG’s currency devaluation program, have also contributed to the strong performance of the Fund’s offshore investments.”

“Domestic listed equities have recorded unrealised capital gain with BSP Financial Group accounting for the majority of the gains. Credit Corporation PNG has also posted unrealised capital gains. This is essentially a pass on from its own shareholding in the BSP Financial Group. CPL shares fell slightly due to the impact of the Black Wednesday riots at the start of the year, recording an unrealised capital loss as a result.”

“For the first time our cash holding is lower than prior years as a result of investments into State Securities and offshore investments. Our strong growth has mainly been driven by the capital appreciation of the offshore and domestic equities, coupled with the impact of the depreciating Kina.”

“This is why NSL employs an investment strategy that aims to reduce risks by running a balanced investment portfolio with about 20% of our investments offshore and about 80% locally invested. This is done to de-risk the Fund and protect our Members’ superannuation savings should one investment not perform well.”

“Despite the very tough local and volatile global economic conditions of 2024, I have no doubt that our Members will be happy with the results of their Fund”

What results are important for Members?

In addition to the successful 2024 results that that Chairman has announced, NSL continues to deliver positive outcomes for our Members such as:

- A total of K1165million in State Share Benefits paid out to 1,112 Members;

- A total of K115 million in Housing Advance paid out to support 5,029 Members purchase, build or improve their homes.

What does NSL's performance look like over the last five years?

Over the last five years, NSL has produced the following results can be seen in the Statistical Summary table below.

| 2024 | 2023 | 2022 | 2021 | 2020 | ||

| Profitability | ||||||

| Total Investment Income | K(m) | 1,298 | 858 | 351 | 737 | 287 |

| Total Expenses | K(m) | 150 | 137 | 129 | 130 | 140 |

| Income Tax Expense | K(m) | 64 | 62 | 78 | 81 | 58 |

| Net Profit after Tax | K(m) | 1,085 | 659 | 144 | 526 | 89 |

| Balance sheet | ||||||

| Net Assets | K(m) | 11,181 | 9,839 | 8,991 | 8,823 | 8,140 |

| Net Asset Growth | % | 13.6 | 9.4 | 1.9 | 8.4 | 6.0 |

| Reserves | K(m) | 56 | 56 | 45 | 42 | 44 |

| Reserves as a percentage of Net Assets | % | 0.5 | 0.6 | 0.5 | 0.5 | 0.5 |

| Return to Members | ||||||

| Interest Credited to Members | % | 10.5 | 7.0 | 1.6 | 6.5 | 1.0 |

| Headline Inflation Rate | % | 3.2 | 3.5 | 6.3 | 5.7 | 5.8 |

| Real Return to Members | % | 7.3 | 3.5 | -4.7 | 0.8 | -4.8 |

| Membership | ||||||

| Number of Members | 235,888 | 228,319 | 220,410 | 214,540 | 207,986 | |

| Average Wealth Per Member | K | 47,400 | 45,067 | 40,792 | 38,689 | 38,814 |

| Number of RSA Members | 6,947 | 6,818 | 6,643 | 5,584 | 4,989 | |

| Number of Choice Super Members | 23,128 | 21,478 | 20,211 | 19,194 | 17,184 | |

| Number of Members making Voluntary Contributions | 35,777 | 33,780 | 31,614 | 30,391 | 28,860 | |

| Number of Pensioners | 240 | 672 | 674 | 674 | 674 | |

| Member contribution & payouts | ||||||

| Contributions received | K(m) | 961 | 970 | 1,025 | 827 | 801 |

| Gross Exit Payouts | K(m) | 703 | 781 | 1,002 | 645 | 441 |

| Total Pension Payments | K(m) | 1.7 | 1.6 | 1.9 | 1.8 | 1.9 |

| Total Benefit Payments made | 30,028 | 30,998 | 30,108 | 26,487 | 23,785 | |

| Trustee expenses | ||||||

| Management Expenses | K(m) | 98 | 87 | 77 | 81 | 76 |

| Investment and Administration Expenses | 53 | 51 | 52 | 49 | 63 | |

| Number of Staff | 250 | 228 | 205 | 192 | 179 | |